For two years, I’ve been on a mission to build my business credit, gain access to capital and educate as many minority, women, diverse small businesses as I could along the way.

I know, I know, I know...you run your business with cash and want to be “debt free”.

Just because you have credit cards doesn’t mean you’re automatically going to be in debt. It’s about leverage. Don’t let these credit repair specialist fool you either - your personal credit matters when building business credit.

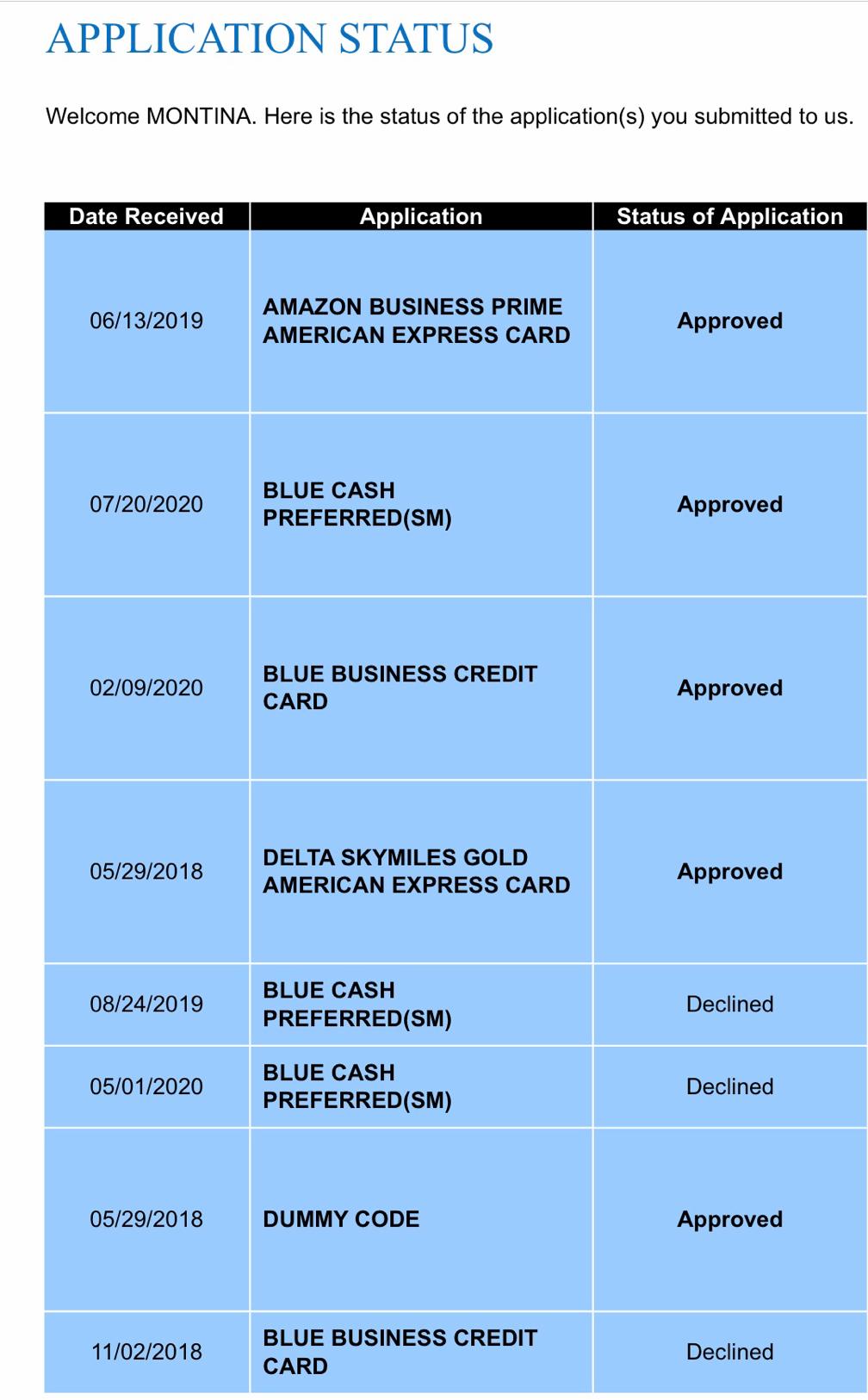

In less than 2 years, I established and gained access to over $500k in business credit including 5 American Express cards (one with no set limit), 4 Mastercards, $4500 in Amazon business credit, $4500 in PayPal business credit, $13k gas cards and much more.

If you’re in business, establishing business credit is extremely important and if you’re a minority or woman owned, it can make or break your business. There’s a strategy to this and it’s not high interest loans and making purchases you don’t need.

I recorded 30+ FREE videos when I started the journey where I share how I managed to build these lines and establish and BUILD business credit. I also share how I get $2500+ back in cash back rewards yearly too.

I share several in the library I created for small business owners.